[ad_1]

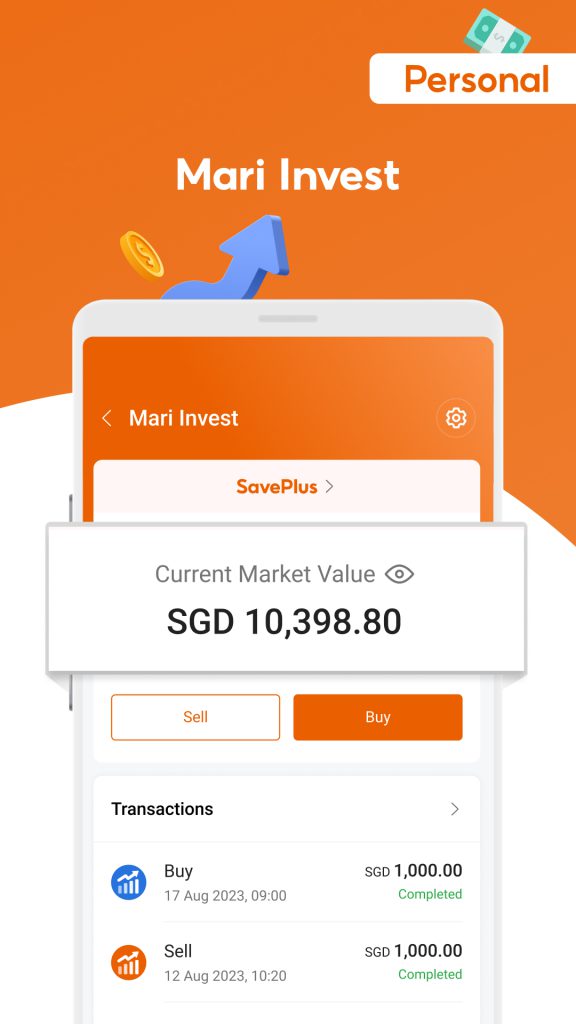

Sea Restricted’s wholly-owned digital financial institution, MariBank, has partnered asset administration firm Lion International Buyers to launch a brand new funding product, Mari Make investments, at this time (October 3).

In response to the digital financial institution, Mari Make investments is the primary funding account by a financial institution in Singapore to supply instantaneous cash-out.

By the funding account, buyers could have entry to low-risk investments reminiscent of MAS Treasury Payments, cash market and high-quality bond funds, in addition to the Lion-MariBank Save Plus fund in collaboration with Lion International Buyers. This allows buyers to reap probably greater returns whereas maintaining total portfolio threat low.

Moreover, Mari Make investments can also be designed to make investing easy by eliminating conventional obstacles to investing, reminiscent of excessive minimal funding quantities, gross sales or platform expenses, and prolonged lock-in intervals with lengthy redemption timelines.

Buyers can begin investing via Mari Make investments with simply S$1 and withdraw their investments immediately in money anytime, capped at S$10,000 per investor day by day, topic to availability. The platform doesn’t cost any gross sales or platform expenses and there aren’t any lock-in intervals or penalties for withdrawals.

We all know that customers at this time need to develop their wealth, however might discover it laborious to make selections with the complicated funding merchandise on the market. That’s why we launched Mari Make investments, it affords shoppers a easy option to handle their wealth with comparatively low threat.

– Zheng Yudong, CEO, MariBank

Mari Make investments enhances MariBank’s flagship financial savings product, Mari Financial savings Account, offering easy and rewarding choices for customers to handle their funds.

The Mari Financial savings Account at present affords a each year curiosity of two.88 per cent, paid day by day, with out the necessity to fulfil any further situations reminiscent of wage crediting or minimal spend.

Featured Picture Credit score: MariBank

[ad_2]

Source link