[ad_1]

To say that 2022 is a catastrophic yr for cryptocurrencies can be an understatement.

Following a sequence of high-profile collapses from stablecoins to crypto exchanges, buyers entered 2023 with a mixture of trepidation and resignation.

Nevertheless, it appears as if cryptocurrencies could be tumbling out of a tough patch as Bitcoin, Ethereum, and several other different cryptocurrencies have began to rise.

At present, the worth of Bitcoin has rallied by no less than a 3rd extra because the begin of the yr.

Is that this a fluke, or has the dreaded ‘crypto winter’ begun to thaw to present solution to summer time?

Has Bitcoin turned bullish?

Despite the fact that the crypto market remains to be a far cry from its peak of near $3 trillion in November 2021, there are indicators that issues are wanting up.

Bitcoin, one of many largest and hottest cryptocurrencies by market capitalisation is experiencing an unexpectedly sturdy begin to the yr.

The query is why.

For a begin, it could be as a result of US Federal Reserve slowing the tempo of its rate of interest hikes, which helped Bitcoin to take care of its rising trajectory and outperform different asset lessons.

As well as, analysts really feel that beneficial market circumstances (i.e. US inflation easing for the seventh consecutive month) might see Bitcoin recapture a few of its losses in 2023.

Based on Nigel Inexperienced, CEO of the monetary advisory agency deVere Group, we’d technically nonetheless be in a bear market, however the indicators are the bulls are starting to take again management.

Halving – a pivotal occasion for Bitcoin

However a extra probably motive behind the bullish behaviour is the as soon as each 4 years Bitcoin halving occasion, which is because of happen in 2024.

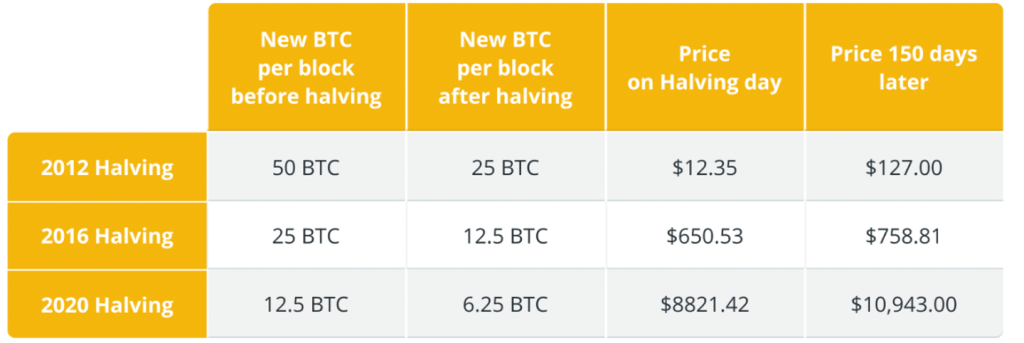

Presently, miners are paid 6.25 BTC for every Bitcoin block mined. This quantity will cut back to three.125 BTC subsequent yr on the halving.

On account of the halving cycle, the provision of obtainable Bitcoin available in the market decreases, which raises the worth of Bitcoins.

For that motive, halving is a monumental occasion that may assist raise the costs of Bitcoin out of the doldrums.

And judging from historic knowledge, buyers can anticipate a surge in Bitcoin’s pricing within the months after halving.

In reality, commodity guru Mike McGlone believes that Bitcoin might attain six figures in a few years.

I totally anticipate Bitcoin within the subsequent couple of years, by most likely across the halving, possibly 2025, to get to US$100,000.

Senior Commodity Strategist at Bloomberg Mike McGlone

Lastly, survival of the fittest is an evolutionary principle that extends to cryptocurrencies.

The shockwaves of 2022, whereas devastating to buyers, ought to be seen as an industry-wide detox to eliminate the black sheep and the weak gamers.

Raoul Ullens, the co-founder of Brussels Blockchain Week, appears to suppose so too.

“An unhealthy ecosystem won’t entice the lots. A drop within the crypto asset markets isn’t solely vital but additionally wholesome, contributing because it does to rebalancing the valuation of cryptocurrencies,” he mentioned.

Cryptocurrencies should not going away

Bitcoin and different cryptocurrencies might need suffered their worst yr, however their greatest followers are greater than conscious of the dangers concerned with this unstable funding and select to make the leap anyway.

And contemplating the rising curiosity within the metaverse, cryptocurrencies will proceed for use as a digital foreign money for transactions within the digital area.

As well as, it’s probably that we are going to see the event of central financial institution digital currencies (CBDCs) sooner or later, a transfer that can give digital belongings extra credence.

Subsequently, whereas the Financial Authority of Singapore (MAS) might need assessed that the case for CBDCs in Singapore isn’t compelling sufficient after a pilot examine, they haven’t dominated out its risk sooner or later.

For individuals who don’t thoughts taking a punt, dipping your fingers into crypto proper now won’t be such a foul concept.

Keep in mind, simply don’t put all of your eggs into one basket.

Featured Picture Credit score: Nasdaq

[ad_2]

Source link